EV adoption is still growing fast. In 2023, EVs grabbed a 12% share of the global market, but that number is expected to increase by 25 – 30% in 2024 to reach a 16% market share that amounts to 13.3 million BEVs sold this year. And yet, in North America, J.D. Power’s 2023 edition of the US Electric Vehicle Experience (EVX) Public Charging study surfaced that public charging station availability is still the top deterrent for EV adoption in North America. Seems range anxiety is still an issue.

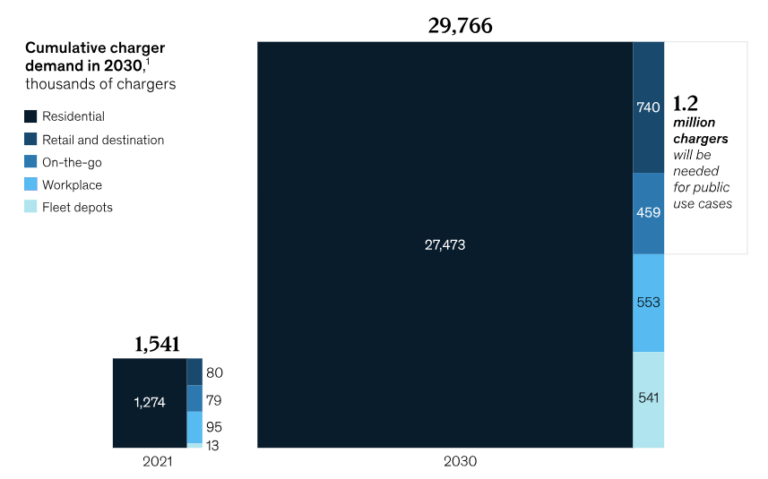

While federal funding aims to install 500,000 chargers by 2030, some estimates show a need for 1.2 million chargers by the end of the decade. This gap presents opportunities for new players to enter the EV charging market. This post will look at a few EV Charging industry trends in 2024; three industries adjacent to EV charging that have recognized the potential and getting into the game. You may be surprised to find out though, that it’s not necessarily direct revenue from EV charging that is tickling their bottom lines.

Cumulative demand for chargers in 2030 in the U.S. (Source: McKinsey)

EV Charging Industry Trends 2024 Will Include New Players Getting into the Game

Charge where you park

Ten years ago, when you wanted to refuel your car, you drove to a gas station. There was no other option. With the emergence of EVs, all that has changed. Many businesses that have a parking lot want to tap into the huge potential of the EV charging market. Think of shopping malls, convenience stores, restaurants, office buildings – anywhere you’d leave your car for an extended period. But they’re not looking at cash for kilowatts. It’s the dwell time that’s ringing up the cash register in their ears. When charging up an EV, people spend an average of 23 minutes at a location compared to 5 minutes when pumping gas. Now, there’s an opportunity. Think of packaged goods, food service, and even a café-like experience connected to EV charging to generate the bulk of the profits.

There are two approaches businesses can take. One is to partner with an established EV charging service provider to set up the EV charging operation. This presents advantages like lowering the costs, quick time-to-market, and benefiting from the provider’s expertise. Another option is to become that EV charging service provider lock, stock, and barrel. This approach might be better suited to large corporations that have resources for such a venture. Walmart is a great example, and the retail giant has announced plans to expand its network of nearly 1300 fast charging stations by adding thousands more at its 5000 plus Walmart and Sam’s Club stores.

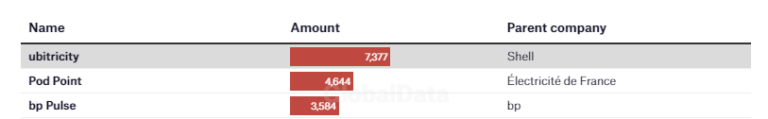

Evolution of gas stations

Oil and gas companies are another example of deep-pocketed corporations, and they too are ramping up their EV charging game, taking advantage of their already-present gas stations. One example is Shell, a company that is using Driivz EV Charging and Energy Management platform to accelerate its deployment of charging locations across Europe. Since Shell’s purchase of Ubitricity in 2021, it has effectively become the largest EV charging network operator in the UK. Similarly, BP is the 3rd largest (as bp pulse) following the purchase of ChargeMaster in 2018.

Total UK charging points by operator (30 September 2023) Source: Energy Monitor

Here too, these business giants are leveraging on that magic dwell time and investing in sprucing up the convenience stores attached to gas stations to entice people with additional goods and services.

Batteries on wheels, charging included

Intuitively, automotive OEMs and EV charging go together. It just makes sense. Buy an EV, and the home charger gets bundled in with the car. But automakers are taking it a step further and forging partnerships to increase their public EV charging stake. This has been Tesla’s model from the get-go, and since you can’t argue with success, others now want in. For example, GM has partnered with EVgo (also using Driivz to power it’s public network of fast EV charging stations) to install thousands of chargers across Pilot and Flying J travel centers across North America.

Not only is GM leveraging the 24/7 amenities offered at the travel centers, but they’re also benefiting from EVgo’s vast experience as one of the largest fast-charging networks in the US, to deliver a seamless charging experience to their drivers. Putting the driver at the center, GM has built EV charging into its apps and will leverage its drivers’ attention to offer exclusive benefits such as reserving chargers and offering discounts for EV charging.

Another example is the Ionna EV charging network, launched by a consortium of seven automotive powerhouses (BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz, and Stellantis). Ionna is trying to give Tesla a run for its money with a mission to deploy 30,000 fast charging stations by 2030 to “make EV charging accessible, reliable, and incredible convenient” as written in their mission statement.

Naturally, the Ionna network will be integrated into each of the OEMs’ EV charging apps. In a separate initiative, Mercedes-Benz is building 400 charging plazas across North America. In line with the brand’s premium status, the sparkling plazas are designed to emanate luxury. While the charging plazas will be open to everyone, Mercedes-Benz drivers will get preferential treatment with enhanced capabilities like reserving chargers. It’s all about customer centricity to foster brand loyalty.

EV charging is not just about kilowatts

While EV charging infrastructure may continue to play catch-up with EV adoption in 2024, it will eventually win. It’s hard to say exactly when, but in the not-too-distant future, EV charging will be as accessible as pumping gas is today. Delivering kilowatts may be the underlying driving force, but these new EV charging network operators are looking at other benefits they hope to gain:

- Monetization, but not directly from kilowatts. They are looking at the dwell time as the window of opportunity to provide EV drivers with an experience (food, products, services, leisure) they’re willing to pay for.

- Brand reputation for being seen as “clean and green “

- Increased customer loyalty fostered by putting drivers at the center and rewarding them for staying with the brand

- New insights into customer behavior around the EV charging experience

When looking at EV Charging industry Trends 2024, let’s see that they all deliver on their promise to deploy all those charging stations. When those targets are met, then range anxiety will truly be a thing of the past.