Key Takeaways

|

Introduction

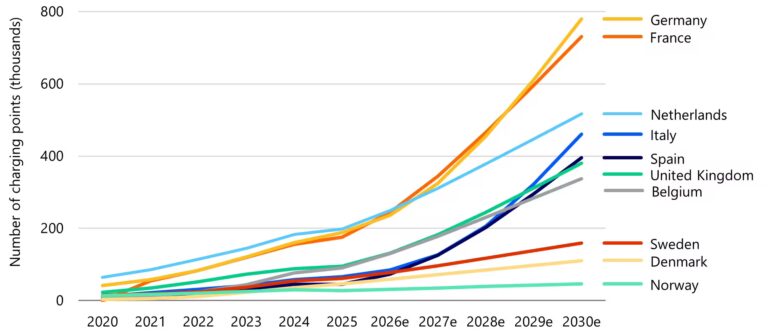

Grid capacity constraints are reshaping charging infrastructure deployment across major markets. The United States faces unprecedented capacity constraints. Europe’s network has reached about 1.2 million public charge points, with DC fast charging growing 37% year-over-year, according to the EVBoosters EV charging network growth report 2025.

The Driivz 2025 State of EV Charging Network Operators Survey found that all EV charging professionals surveyed expect grid capacity to impact expansion, with 82% anticipating moderate constraints and 10% expecting significant limitations. Traditional deployment strategies relying on utility grid upgrades face delays of years.

But forward-thinking charge point operators can work ahead of and around grid capacity constraints by combining strategic technology deployment with intelligent energy management. The first step to overcoming these capacity challenges is understanding where and how grid limitations impact network expansion.

The Grid Capacity Challenge

Grid interconnection backlogs often cause multi-year deployment delays, prompting operators to pursue alternative network expansion strategies. Addressing this challenge is essential to developing effective solutions.

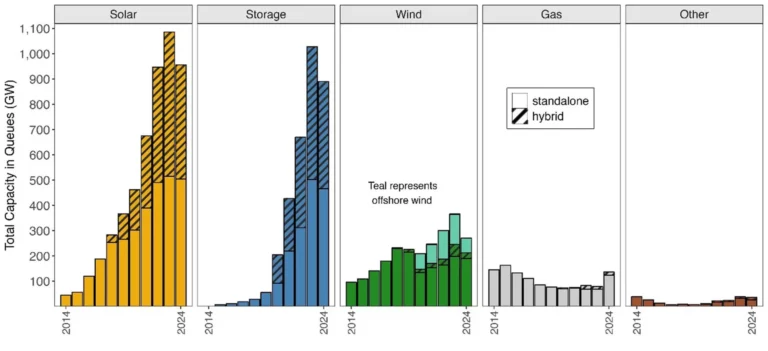

United States

Lawrence Berkeley National Laboratory’s August 2025 data shows that active grid connection requests reached about 2,300 gigawatts by the end of 2024. This is more than twice the current total installed capacity in the United States, underscoring the demand for grid access. Solar, battery storage, and wind energy make up 92% of all active capacity in interconnection queues.

A July 2025 Morgan Lewis analysis found that projects are experiencing an average five-year gap between interconnection request and commercial operation. This increase over historical timelines results in substantial delays for operators deploying new charging infrastructure.

Europe

A 2025 Rabobank analysis reports that grid connection timelines for charging infrastructure in Europe have increased from six months to two years. This challenge has intensified because of faster EV adoption and greater infrastructure needs.

An October 2025 FIA Region 1 report indicates that over 90% of charging network operators expect grid capacity constraints to impede expansion. The report identifies grid constraints as the most significant barrier to deploying public charging infrastructure.

The Alternative Fuels Infrastructure Regulation (AFIR) mandates the installation of 150 kW fast chargers every 60 kilometers along the Trans-European Transport Network (TEN-T) beginning in 2025, thereby increasing pressure on grid infrastructure.

Battery Storage Solutions

How can battery storage help you deploy EV charging infrastructure in grid-constrained locations?

Battery storage systems support EV charging operations in grid-constrained locations by storing energy during low-demand and low-cost periods, then supplying it during peak charging sessions. This lets operators begin operations at sites that would otherwise require extensive grid upgrades.

The Driivz Q1 2025 survey shows that 17% of operators have deployed battery storage, and 73% plan to implement it within the next 12 months. This trend reflects growing recognition of battery storage as a key tool to supplement grid power and support network expansion.

National Renewable Energy Laboratory (NREL) analysis of grid-constrained sites shows that battery-buffered 150-kW charging ports require at least 120 kWh of storage per port to deliver 150 kWh in the first hour of charging. This provides operators with clear guidance for battery system sizing.

Operational Benefits

- Reduction of peak demand charges: Battery storage supplies power during high-cost periods, lowering demand charges and reducing operating costs.

- Facilitation of faster deployment: Charging operations can begin with available grid capacity, allowing operators to avoid or defer costly grid infrastructure upgrades.

- Provision of load balancing: Smart Energy Management platform distributes available power across concurrent charging sessions, preventing sites from exceeding electrical capacity during peak usage.

- Support for renewable integration: On-site solar generation can be stored for later use, reducing reliance on the grid and lowering energy costs.

- Enablement of gradual capacity expansion: Operators can scale battery capacity over time without a large upfront investment in grid infrastructure.

Demand Response and Intelligent Energy Management

Participation in flexible grid services enables the EV charging infrastructure to actively support the power grid rather than solely draw electricity from it. This creates additional revenue streams for operators while improving the financial case for expanding charging networks.

Modern EV charge point management systems (CPMS) enable operators to coordinate these energy management strategies through unified software platforms. Advanced CPMS solutions provide real-time visibility into energy consumption across all charging ports, dynamically allocate available power based on demand, and automatically adjust charging schedules to optimize both grid services and EV driver experience.

- Financial compensation for load adjustment: Operators adjust charging loads during grid stress in exchange for utility payments.

- Unique grid value from EV flexibility: The S. Department of Energy Congressional Report on EV Grid Impacts notes that EVs offer flexibility in the timing and location of energy use, providing unique value for grid services.

- Off-peak charging benefits: Charging during low-demand periods lowers energy costs and supports grid stability.

- Bi-directional communication capability: AFIR technical specifications require charging points to support bi-directional grid communication, enabling advanced demand management capabilities.

- Intelligent load management: CPMS platforms dynamically distribute available power across multiple charging sessions, preventing demand spikes while maximizing throughput and energy sales.

Grid Constraint Solutions: Comparison Table

| Solution | Primary Benefit | Best For | Adoption Status |

| Battery Storage | Deploy fast EV charging without grid upgrades | Grid-constrained sites, fleet depots | 17% deployed, 73% planning (Driivz 2025 Survey) |

| Demand Response | Generate revenue from grid services | High-capacity sites, fleet operations | Growing utility program availability |

| Dynamic Load Management | Maximize chargers within existing capacity | Multi-port sites, mixed-use locations | Standard in modern CPMS platforms |

| Solar + Storage Integration | Reduce grid dependency and energy costs | Sites with available space | Increasing with renewable incentives |

Conclusion

Strategic energy management offers practical ways to expand the network despite grid constraints. Battery-buffered systems, demand response programs, and intelligent EV charging management platforms facilitate deployment while addressing capacity limitations. Advanced CPMS solutions enable operators to dynamically manage energy distribution, optimize charging schedules, and coordinate battery storage and grid services through a unified software platform.

The Driivz survey shows that 90% of operators plan to deploy battery storage within the next year, highlighting industry recognition of these solutions. As interconnection timelines grow and regulations tighten, operators using comprehensive energy management systems gain advantages through faster deployment, better reliability, and improved financial performance.

For EV Charging providers facing grid constraints, the path forward is clear: implement energy management strategies that support growth within existing infrastructure and prepare for future expansion. Learn more about how Driivz smart energy management solutions can help accelerate your network expansion.